Medicare tax calculator 2023

Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

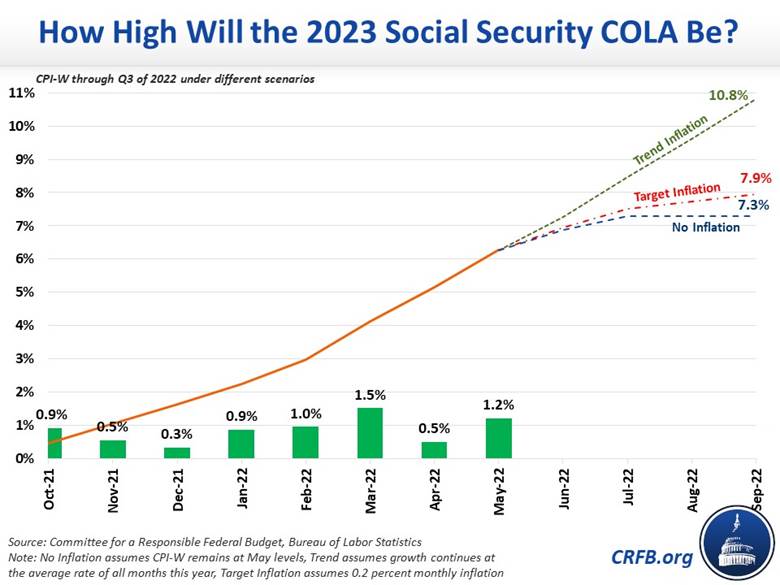

Could 2023 Social Security Cola Hit 9 Benefitspro

Estimate my Medicare eligibility premium.

. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Heres what you need to know. Discover Helpful Information And Resources On Taxes From AARP.

The Australian Salary Calculator includes income tax deductions Medicare. Self-employed people are allowed to deduct their health insurance premiums on Schedule 1 of the 1040 form as an above the line deduction. 2023082 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. With 0 inflation from July 2022 to August 2023 the first tier IRMAA is projected to increase from 194000 for year 2023 to 202000 for year 2024. Calculate Your 2023 Tax Refund 2021 Tax Calculator Estimated Results 0000 Filing Status Dependents Income Deductions Other Credits Paid Taxes Results Estimate Your 2022 Tax.

The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income. Sign up for a free Taxpert account and e-file your returns each year they are due. Begin tax planning using the 2023 Return Calculator below.

2023 Mar 2022 - Feb 2023 2022 Mar 2021 - Feb 2022 2021 Mar 2020 - Feb 2021 2020 Mar 2019 - Feb 2020 What is your total salary before. 2022 Federal income tax withholding calculation. What is a 20232k after tax.

The Medicare tax rate is 145. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. This calculator estimates the social security and medicare taxes payable by you on your wages as an employee the social security and medicare taxes payable on your self-employment income.

May not be combined with other. The salary calculator for income tax deductions based on the latest Australian tax rates for 20222023. Social Security and Medicare Withholding Rates.

How Do You Calculate Medicare Tax Employers and employees split the tax. 2023202 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. Calculate Your 2023 Tax Refund.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Subtract 12900 for Married otherwise. Return filed in 2023 2021 return filed in 2022.

The current rate for. What is a 202308k after tax. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

FICA taxes include both the Social Security Administration tax rate of. Get a head start on your next return. Which tax year would you like to calculate.

For example based on the 2022 income chart if you filed individually and your 2020 MAGI was over 91000 but no more than 114000 or if you filed as a married couple and your. The FICA portion funds Social Security which provides. Up 8000 with 0 inflation.

For both of them the current Social Security and Medicare tax rates are 62 and 145. You may get a reduction or exemption from paying the Medicare levy depending on. But the Federal Insurance Contributions Act tax combines two rates.

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Form 941 For 2023

2023 Icd 10 Cm Professional For Physicians With Guidelines 9781622548361 Medicine Health Science Books Amazon Com

Social Security What Is The Wage Base For 2023 Gobankingrates

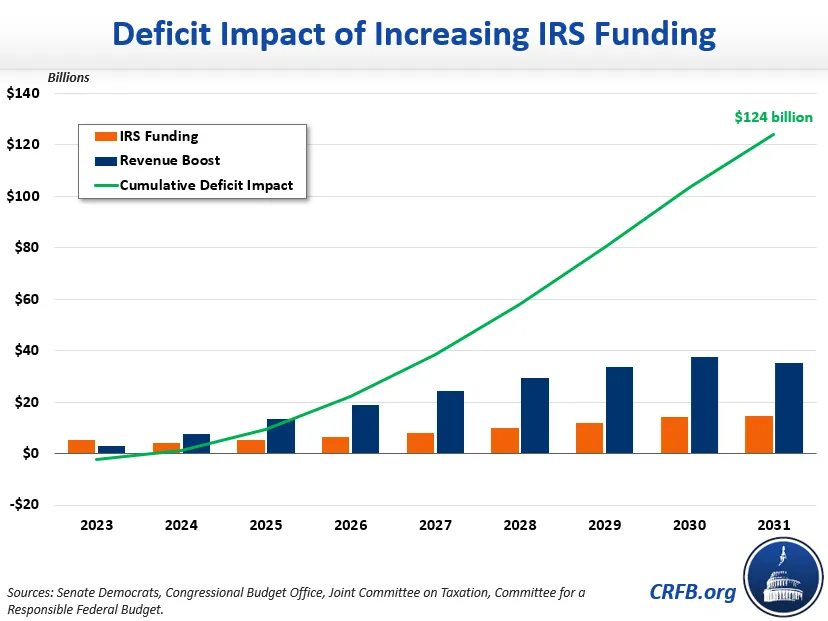

The Inflation Reduction Act Would Reduce The Tax Gap Committee For A Responsible Federal Budget

2023 San Francisco Hcso Expenditure Rates Released

You Won T Believe The Size Of This 2023 Social Security Cola Estimate 401 K Specialist

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Increase In Social Security Benefits In 2023 How Much Will Recipients Get Silive Com

4 Social Security Changes To Expect In 2023 The Motley Fool

Why A Record Cola Increase In 2023 Could Backfire On Seniors

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

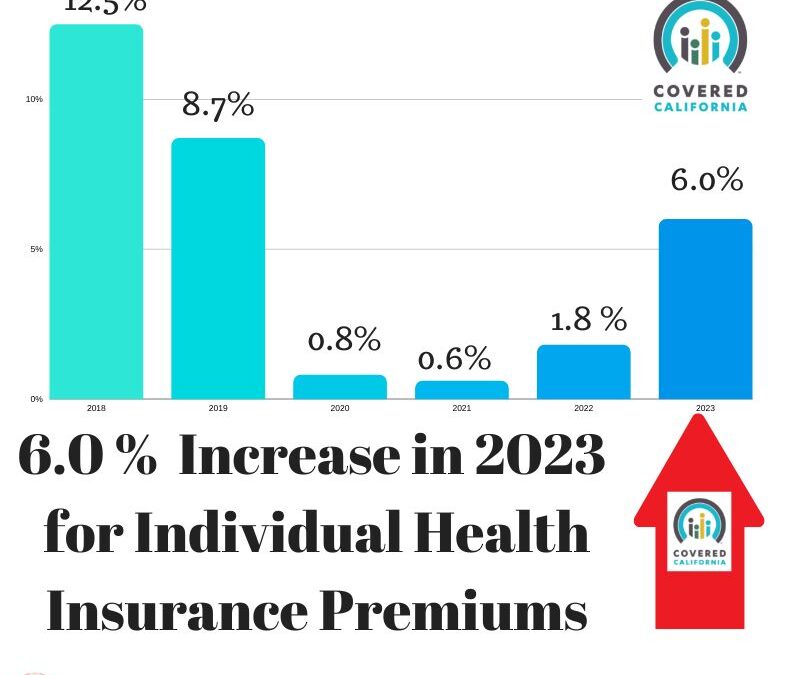

Covered California Announces Its 2023 Rate Increase Solid Health Insurance

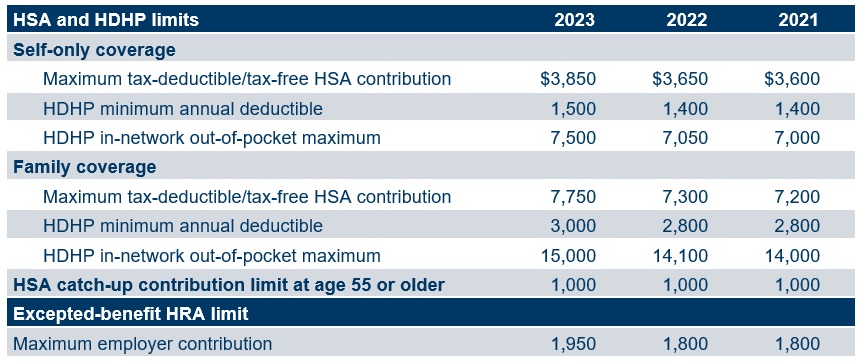

2023 Hsa Hdhp And Excepted Benefit Hra Figures Set Mercer

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Calendar Year 2023 Medicare Physician Fee Schedule Proposed Rule Part 2 Youtube

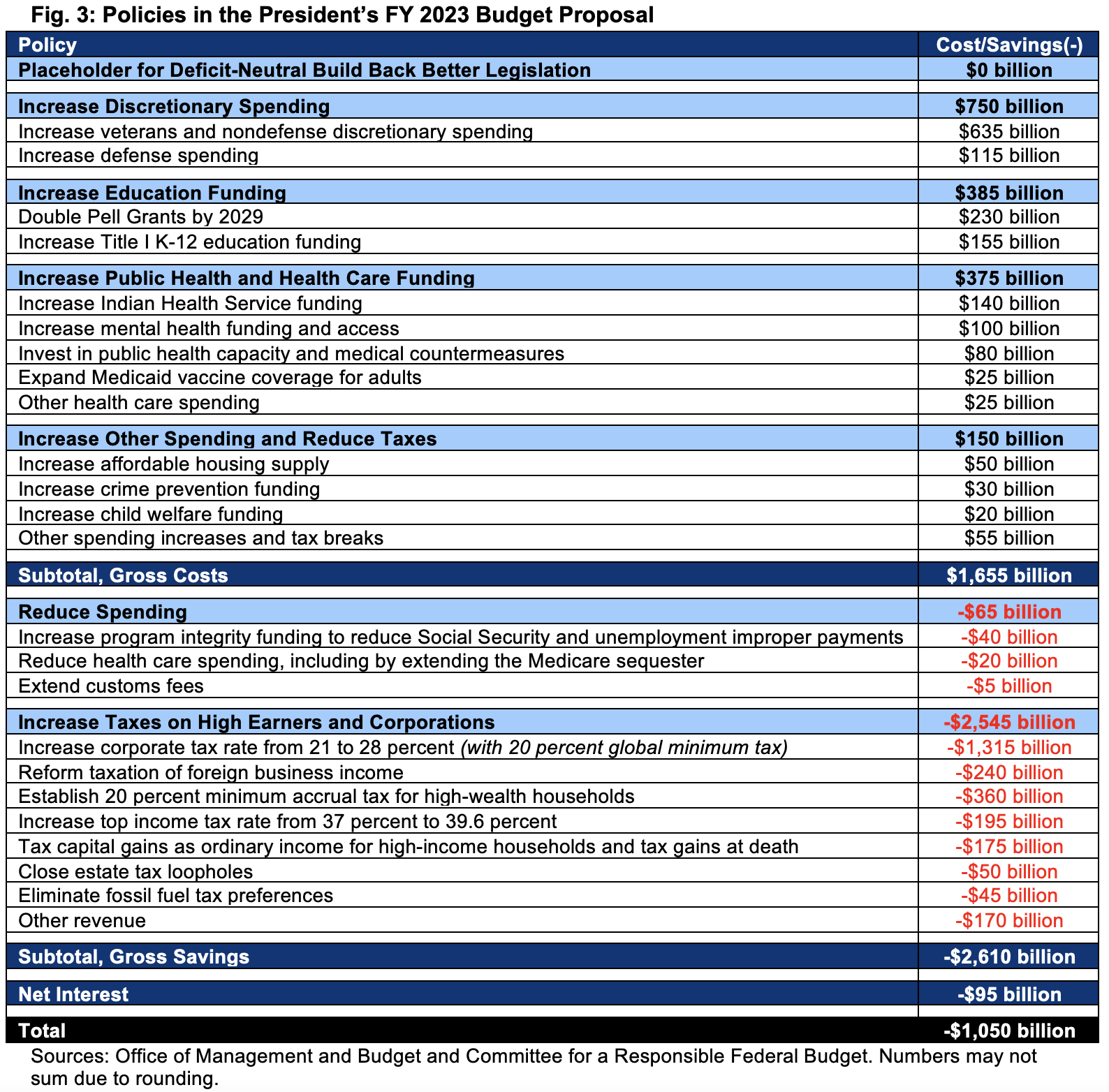

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget